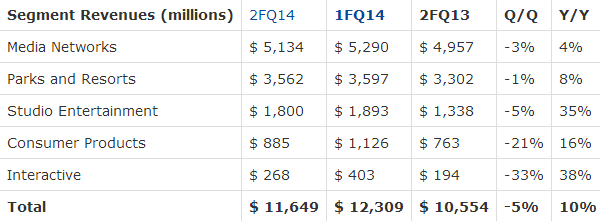

According to CNBC, the company posted earnings of $1.11 a share, excluding one-time items, on sales of $11.65 billion. Analysts had expected the company to report earnings excluding items of 96 cents a share on $11.25 billion in revenue, according to a consensus estimate from Thomson Reuters.

The earnings of $1.11 a share were 11 cents higher than the highest of 27 Wall Street estimates for the quarter.

Shares gained in extended-hours trading.

"We're extremely pleased with our results this quarter, delivering double-digit increases in operating income across all of our businesses and the highest quarterly earnings per share in the history of the Company," said Disney CEO Robert Iger, in a press release. "Our continued strong performance reflects the strength of our brands, the quality of our content, and our unique ability to leverage creative success across the entire company to drive value."

Disney announced at the end of March that its recent animated film "Frozen" topped $1 billion in revenues, making it the highest-grossing animated film of all time.

Read More Now

Media Networks delivered higher operating income in the second quarter due to growth at both cable and broadcasting. At cable, growth in operating income was driven by ESPN, domestic Disney Channels and higher equity income from Disney's investment in A&E Television Networks.

|

| Jay Rasulo |

During the second quarter, ESPN deferred $80 million less in affiliate revenue than in Q2 of last year, due primarily to the signing of a new affiliate contract. Rasulo told analysts on the company's earnings call, "As we look to the third quarter, we expect ESPN to recognize approximately $190 million less in previously deferred affiliate revenue compared to the prior year. I'll remind you these changes have no impact on full year results."

Ad revenue at ESPN declined low single-digits in the second quarter due to a decrease in units sold and lower ratings, partially offset by higher rates. The marketplace was not particularly robust in the second quarter, according to Rasulo. So far this quarter ESPN ad sales are pacing up mid single-digits, driven by demand for the World Cup.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.