In response to common audio planning questions, the media strategy and creative advisory team, CUMULUS MEDIA | Westwood One Audio Active Group, has developed the Audio Planning Guide. The data is sourced from Edison Research’s “Share of Ear” Report, Nielsen’s Nationwide, and the Scarborough Podcast Buying Power study.

This week’s CUMULUS MEDIA | Westwood One Audio Active Group blog highlights some of the key findings.

- Many media strategists and planners mistakenly believe Pandora and Spotify have the largest share of ad-supported audio listening. At a 76% share, Edison Research’s “Share of Ear” reveals AM/FM radio is the dominant ad-supported audio platform.

- From the Q2 2021 “Share of Ear” study, Edison reports the 76 share of AM/FM radio is 13 times larger than Pandora and 19 times larger than Spotify.

- The Audio Planning Guide includes recommended GRP thresholds for light, medium, and heavy AM/FM radio campaigns determined via Nielsen Media Impact.

- According to the Nielsen Commspoint, the media planning platform, a reallocation of 20%-30% of the TV budget to AM/FM radio generates significant lift in incremental reach.

- One of biggest misperceptions of AM/FM radio is that it is a “drive time” medium. The reality is only 40% of U.S. AM/FM radio listening occurs during mornings and afternoon drive times. 60% of U.S. AM/FM radio listening occurs outside of drive times.

- 70% of the U.S. population resides in the top 50 markets. 70% of AM/FM radio’s reach in the U.S. comes from the top 50 DMAs. A smaller proportion of AM/FM radio time spent (59%) occurs in the top 50 DMA markets. If a brand wants to assess their AM/FM radio deliveries by market size, they should peg their index of tuning based on the AM/FM radio reach generated, not time spent.

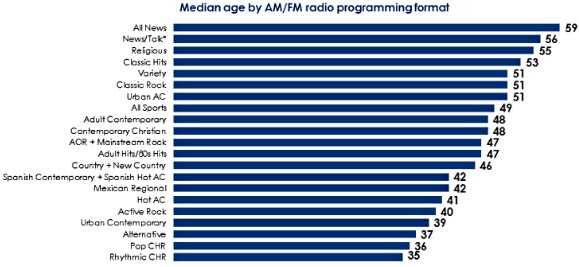

- The Audio Planning Guide includes the age and gender profiles of AM/FM radio programming formats as well as which charitable and brand-purpose initiatives resonate with various format audiences.

- Given the 41% monthly reach, podcasting can no longer be dismissed as a low-reach media platform. From Nielsen Scarborough’s Podcast Buyer Power study, the Audio Planning Guide outlines monthly reach by podcast genre.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.