In Jacobs Media’s Techsurvey 2019 – the 15th annual online mega-survey of radio listeners – a sustained pattern of increased digital listening continues to take place in radio’s traditional listening locations – the home, the car, and the workplace.

From the rise of voice command technology and smart speakers to heavier usage of podcasts and on-demand audio, the media usage and radio listening landscapes continue to evolve.

The media habits of 14 format core audiences, along with five generations, are examined in this annual survey of more than 50,000 radio listeners. From Boomers to Millennials, different patterns of consumption continue to emerge, providing radio broadcasters with the tools they need to map out game plans and strategies.

The survey was fielded in early 2019 between January 3 – February 3.

A free webinar -- “10 Key Takeaways from Techsurvey 2019” -- is scheduled for Monday, April 15 at 2pm ET. Registration info is here.

As Jacobs Media President Fred Jacobs points out, “For radio, Techsurvey is our ‘AI’ – Audience Intelligence to help programmers, managers, and owners understand the changing terrain. This is the largest research study of its kind in the world – a unique look at the American commercial radio audience.”

Once again this year, Jacobs Media’s Director of Research, Jason Hollins, was the “showrunner” for this massive study.

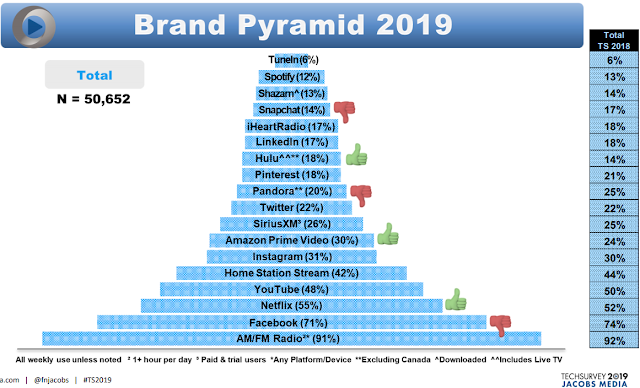

Techsurvey 2019’s “Media Pyramid” reveals continued growth for smart speakers, in-car connectivity, and video streaming. The “Brand Pyramid” provides fascinating usage and up-trending on video streaming brands that include Netflix, Instagram, and Amazon Prime Video, while tracking lower usage numbers for Facebook, Pandora, and Snapchat.

Paul Jacobs, Jacobs Media General Manager, continues, “With market level data for our ‘stakeholder’ radio stations, and great tracking across 14 different formats, Techsurvey provides a unique perspective on the media landscape, and where radio fits in. This information is invaluable not only for Program Directors and digital managers, but for the sales department as well.”

More than nine in ten respondents spend at least one hour a day with radio and/or television, the foundation of this pyramid.

This year’s Media Pyramid is below:

Other highlights include:

- The rise of voice. Smart speakers (Amazon Alexa, Google Home, etc.) are now owned by more than one in four respondents (27%), up from 11% just two years ago. And among all smart speaker owners, half own at least two of the devices in their households.

- Broadcast radio: free & easy. Consumers continue to love broadcast radio for the music, personalities, and emotional drivers, such as companionship and mood elevation. However, seven in ten (71%) say the fact it is easiest to listen to in the car is a main reason they enjoy listening to the radio (the most mentioned response among the choices presented), while more than six in ten (62%) say a prime motivator for listening to broadcast radio is that it’s a free service.

- Advantage AM/FM radio: It’s local. Fully 86% of respondents agree that “one of radio’s primary advantages is its local feel.” This is up from 77% three years ago.

- Radio’s digital platforms continue their growth. While 65% of consumption to the average station in TS 2019 takes place on “regular radios,” 31% of radio station listening is via digital platforms – computer streams, mobile apps, smart speakers and podcasts (up from 27% in TS 2018). By generation, the traditional vs. digital listening gap is most narrow among Millennials, with 35% of their listening coming from digital platforms (vs. 61% on a regular radio).

- Podcasting’s cume: flat, while “TSP” (time spend podcasting) is growing. While weekly podcast/on-demand audio listening remained mostly flat overall (21% vs. 23% one year ago), its momentum among those who listen is growing rapidly. Four in ten weekly podcast listeners say they are listening to more podcasts now than one year ago. Weekly podcast listeners who consume six or more podcast episodes in an average week also rose year-over-year, to 24% (vs. 17% in TS 2018). In addition, two-thirds of regular podcast listeners (weekly or more) say they save podcasts and come back to finish listening when they have more time, rather than leave them unfinished.

- Privacy & misuse of data – a growing concern. More than three in four (77%) say they are concerned with the ways in which tech companies use their data, particularly among older generations (82% of Baby Boomers, and 81% of the Silent Generation.) Additionally, about one-fourth of all respondents say they have deleted Facebook or are seriously considering it, mostly because of privacy issues.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.