Consumers spend 31% of their media time with audio, yet audio is only allocated 8.8% of media budgets. Other media represent 91.2% of ad spend and 69% of consumer media use.

With 75,000 marketer clients in over 100 countries, WARC’s purpose is “to put evidence at the heart of every marketing decision.” Their belief is that effective marketing is based on facts, not opinions. For over thirty years, WARC has brought confidence to marketing decisions through the most trusted research, case studies, best practices and data.

Audio is under-researched as a platform for reach growth and expanded share of consumer attention

Paul Coxhill, Managing Director at WARC, says, “The changing role of Audio has been a relatively under-researched area of the Marketing Media Mix. This study, with iHeartMedia, starts to address that. The study investigates whether there’s a disjoint between consumer consumption and media allocation of audio as a channel. The findings are fascinating and demonstrate a real opportunity for brands to expand their brand reach and, if done well, their share of consumer attention by expanding the role of Audio in their media mix.”

With 75,000 marketer clients in over 100 countries, WARC’s purpose is “to put evidence at the heart of every marketing decision.” Their belief is that effective marketing is based on facts, not opinions. For over thirty years, WARC has brought confidence to marketing decisions through the most trusted research, case studies, best practices and data.

Audio is under-researched as a platform for reach growth and expanded share of consumer attention

Paul Coxhill, Managing Director at WARC, says, “The changing role of Audio has been a relatively under-researched area of the Marketing Media Mix. This study, with iHeartMedia, starts to address that. The study investigates whether there’s a disjoint between consumer consumption and media allocation of audio as a channel. The findings are fascinating and demonstrate a real opportunity for brands to expand their brand reach and, if done well, their share of consumer attention by expanding the role of Audio in their media mix.”

WARC’s analysis of brands reveals four types of marketers:

- Digital Onlys: These brands have started to invest using podcasts and audio streaming and achieve modest reach and scale. They miss out on the full suite of audio options. Their opportunity is to scale impact with the addition of AM/FM radio, which represents 70% of the ad-supported audio market.

- Audio Avoiders: They are the 25% of marketers who have no audio in the media plan.

- Cross-Platform Champions: They explore audio’s full potential and continue to test, learn from, and optimize their investments across platforms.

- Broadcast Believers: This group has seen the benefits of AM/FM radio and are beginning to delve into more forms of audio.

This week’s CUMULUS MEDIA | Westwood One Audio Active Group blog outlines the key takeaways for advertisers.

- The investment gap: Consumers spend 31% of their media time with audio, yet audio is only allocated 8.8% of media budgets. Other media represent 91.2% of ad spend and 69% of consumer media use.

- Linear TV consumption has dropped -25%: Currently, linear TV’s share of media time spent is down to 24% from 32% in 2012, a -25% decrease.

- Marketers overspend on digital and TV, and underspend on audio: WARC’s analysis reveals brands are overspending on TV and digital by 32%, and underspending on audio by a factor of 3X.

- Nielsen: AM/FM radio makes your TV and digital better with significant lifts in reach: A $2 million TV and digital investment reaches 27% of Americans. Shifting 30% of the media plan to AM/FM radio lifts reach from 27% to 47%, a +74% increase.

- P&G: AM/FM radio generates a +36% increase in monthly reach for the average brand: An incremental reach analysis of 15 P&G brands conducted via Nielsen Media Impact, the media optimization platform, reveals the average P&G brand experiences a +36% increase in reach to their TV plan through the use of AM/FM radio.

- AM/FM radio’s superpower: The younger the demographic, the greater the lift in reach: Across P&G’s 15 brands, the lift in reach generated by AM/FM radio keeps growing in younger demographics. Among persons 35-44, the average P&G brand realizes a +63% increase in reach due to AM/FM radio. Among persons 25-34, AM/FM radio doubles the TV reach.

- Nielsen sales effect studies: Dozens of Nielsen sales lift studies across 14 categories reveal AM/FM radio achieves a $5.06 return on advertising spend for CPG brands and a $14.74 ROAS for retail advertisers.

- Ad-supported audio evolution: AM/FM is dominant, podcasts and AM/FM radio streaming grow, and Pandora and Spotify stagnate, according to Edison Research’s “Share of Ear.”

- Podcasts: offer marketers an educated and upscale audience with a median age of 34.

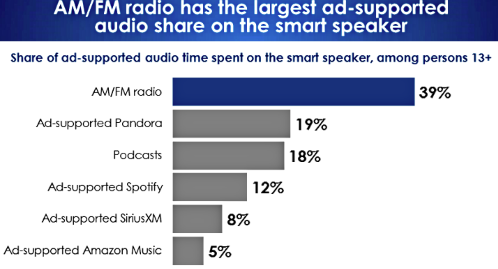

- Device innovation: Smart speakers bring AM/FM radios back into the home: Smart speaker ownership has reached 40% of Americans.

Click here to view a 13-minute video of the key findings.

ALSO READ: Digital Advertising Still Growing, But Faces Concerns, IAB Report Says

ALSO READ: Digital Advertising Still Growing, But Faces Concerns, IAB Report Says

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.