Audacy Inc. Chief Executive Officer David Field made a big bet when his Philadelphia-based company purchased CBS Radio for about $1.5 billion in 2017.

The deal tripled the size of the business started by his father in 1968, making Audacy the second-largest radio-station operator in the US by revenue. In a memo to staff at the time, Field promised big investment in capabilities and people.

“We are also done apologizing about radio,” he said, saying the medium was “massively undervalued.”

Bloomberg's Ashley Carman reports now, six years later, Audacy is struggling under the weight of $1.92 billion in debt and shriveling demand for radio advertising, an industrywide plague. The broadcaster, whose stable of over 220 stations includes 1010 WINS in New York and KNX in Los Angeles, has been in restructuring talks with creditors, according to filings.

The US’s 11,000 or so commercial radio stations — from large operators like Audacy to smaller groups — are suffering from the same headwinds as other traditional media. Stations are losing their grip on younger audiences, and advertisers are tuning out. Fresh sources of revenue, like podcasts and streaming audio, are going to new contenders such as Spotify Technology SA or just failing to make up for the lost radio ad dollars.

“Legacy media is not sexy,” said Larry Rosin, president at Edison Research. “It’s not an exciting thing that looks like the future, and that’s a problem.”

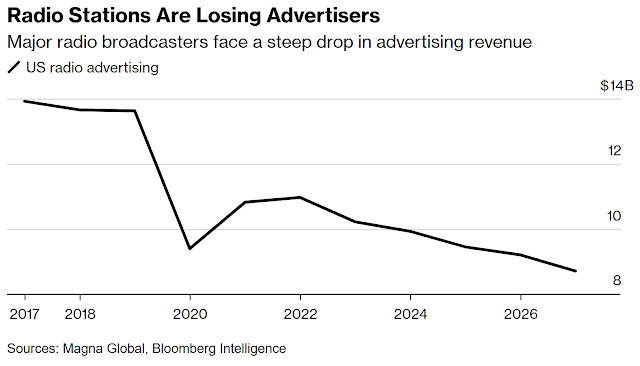

Major radio broadcasters face a steep drop in advertising revenue

Shares of Audacy trade at just 30 cents and were delisted by the New York Stock Exchange. The family’s stake in the business, worth more than $150 million at the time of the merger, has shrunk to just a few hundred thousand dollars. Audacy declined to comment for this article.

The company, previously known as Entercom Communications, is hardly alone. The shares of industry leader IHeartMedia Inc., which has more than 850 stations, are down 60% this year, and No. 3 Cumulus Media Inc. said revenue at its 400 or so stations fell 17% in the third quarter.

With new options like Spotify, people don’t turn to radio to discover new music as much as they used to, according to Jacobs Media. The share of Americans ages 12 and older who listen to radio declined to 82% last year, from 92% in 2009, according to Pew Research.

The industry’s biggest source of revenue, local and national ads, is in free fall. Audacy said such revenue fell 9.3% in the third quarter, and it expects a similar drop this period. IHeart said on Nov. 9 that broadcast revenue dropped by 6.1% in the third quarter. It expects total revenue to slump by a high-single-digit percentage in the fourth quarter after falling 3.6% in the prior period. Audacy’s overall revenue decreased by 5.6% in the third quarter.

Even with the promise of political advertising next year, the prospects remain grim. “The broadcast marketplace is extremely soft for ’23 and similarly for ’24,” said Lauren Russo, an executive vice president at advertising buyer Horizon Media. “The overall audio ecosystem continues to grow from a streaming and podcasting perspective, but at the expense of broadcasts.”

Audacy’s radio business prior to the pandemic relied heavily on automotive advertisers, which cut spending partly due to supply-chain issues during the pandemic. On the company’s second-quarter earnings call in 2022, Field said auto spending was 40% below 2019 levels, costing the company about $60 million.

One problem: Radio relies on old-fashioned methods of measuring listeners, according to Horizon’s Russo. Online players like Spotify employ technology that targets audiences and tracks ads in a more granular way, boosting their appeal to sponsors.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.