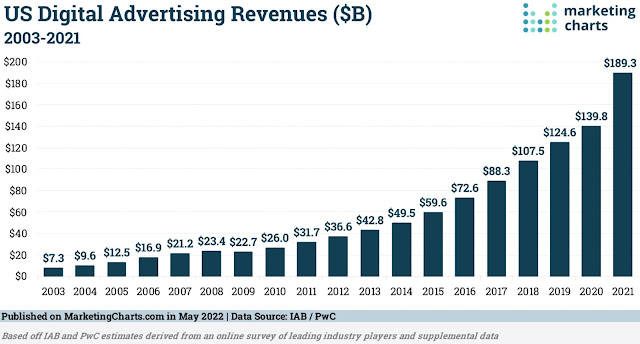

Digital ad spend swelled by 35.4% year-over-year in 2021, representing the fastest growth rate since 2006 and almost 3 times the rate (12.2%) from a year earlier, according to the IAB.

Here are some takeaways from the IAB report.

Digital Audio and Video Set the Pace

Mobile’s ascent in digital advertising has been undeniable over the past decade or so, rising from just 9% of revenues in 2012 to 70% by 2019. However, since then it has remained at about that 70% mark, both in 2020 and in 2021 (71% share). As the IAB notes, “mobile growth, as expected, has plateaued due to penetration.”

All told, advertisers spent $135.1 billion on mobile ads last year, up from $98.3 billion the year prior and setting a new high water mark. Desktop advertising spend also jumped to a new high of $54.2 billion, from $41.5 billion in 2020.

Search Still Leads All Formats

Search continues to be the dominant digital advertising format, though it is ceding share to faster-rising formats such as video. Last year search accounted for 41.4% share of total digital ad revenues (down from 42.2%), with display comprising 30% share (down from 31.5%), digital video 20.9% share (up from 18.7%) and other formats combining for the remaining 7.8% share (up from 7.6%).

Search accounted for a larger portion of revenues on desktop than on mobile, whereas display had a greater presence on mobile than desktop.

Digital Ad Revenues Still Highly Concentrated

The top 10 companies accounted for 78.6% of all digital ad revenues last year, up from 78.1% in 2020 and 76.6% a year earlier. With the next 15 companies occupying another 6.5% share of revenues, just 14.9% were left for all the remaining publishers to fight over. With digital ad revenues totaling $189.3 billion last year, this implies that for all but the largest 25 companies, the actual amount of ad spend in play was a little over $28 billion.

Other Findings:

Digital Audio and Video Set the Pace

- Digital audio was the fastest-growing digital advertising channel last year, with its growth rate being 64% higher than the overall total, at 57.9%. However it remains a small piece of the digital advertising pie, at 2.6% share of total revenues. Digital audio advertising is largely a mobile affair, as mobile’s share of revenue grew to 85%.

- Digital video was the next-fastest-growing channel, 44% higher than the average with a growth rate of 50.8%. Digital video ad spend saw strong growth across both mobile (47.8%) and desktop (58.2%), in so doing exceeding one-fifth (20.9%) share of US digital ad revenues for the first time.

Mobile’s ascent in digital advertising has been undeniable over the past decade or so, rising from just 9% of revenues in 2012 to 70% by 2019. However, since then it has remained at about that 70% mark, both in 2020 and in 2021 (71% share). As the IAB notes, “mobile growth, as expected, has plateaued due to penetration.”

All told, advertisers spent $135.1 billion on mobile ads last year, up from $98.3 billion the year prior and setting a new high water mark. Desktop advertising spend also jumped to a new high of $54.2 billion, from $41.5 billion in 2020.

Search Still Leads All Formats

Search continues to be the dominant digital advertising format, though it is ceding share to faster-rising formats such as video. Last year search accounted for 41.4% share of total digital ad revenues (down from 42.2%), with display comprising 30% share (down from 31.5%), digital video 20.9% share (up from 18.7%) and other formats combining for the remaining 7.8% share (up from 7.6%).

Search accounted for a larger portion of revenues on desktop than on mobile, whereas display had a greater presence on mobile than desktop.

Digital Ad Revenues Still Highly Concentrated

The top 10 companies accounted for 78.6% of all digital ad revenues last year, up from 78.1% in 2020 and 76.6% a year earlier. With the next 15 companies occupying another 6.5% share of revenues, just 14.9% were left for all the remaining publishers to fight over. With digital ad revenues totaling $189.3 billion last year, this implies that for all but the largest 25 companies, the actual amount of ad spend in play was a little over $28 billion.

Other Findings:

- Digital ad revenues grew fastest in Q2 2021, when they rose by an impressive 62.2% year-over-year.

- Second-half revenues broke the $100 billion mark for the first time, at $102.8 billion. The previous high had been $80.5 billion.

- Programmatic ad revenues increased by a slightly above-average rate of 39%.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.