Local advertising isn’t quite shaping up as the bountiful year that many had hoped for, but it’s still on pace to grow a healthy 3.2%, according to a new forecast released by Borrell Associates. Looking longer range, Borrell foresees local advertising growing at a 2.2% Compound Annual Growth Rate over the next five years.

The ad-tracking company’s initial forecast for 2024, issued last November, was 1.2 points higher. The downward adjustment was triggered by new information from Borrell’s principal sources, including the U.S. Bureau of Labor Statistics, Woods & Pool, D&B, IBIS World, and Borrell’s quarterly SMB Business Barometer.

“For the past three quarters, we haven’t seen a lot of variation in SMBs’ attitudes about the economy and their plans to invest in advertising,” said Corey Elliott, Executive Vice President of Local Market Intelligence and Borrell’s chief forecaster. “They’re mostly neutral and slightly positive about the economy, but we’re still not seeing anything that would signal the bigger spring-back that many are hoping for.”

Since Q3 of last year and continuing through Q2 of this year, Borrell’s barometer survey has shown that a consistent 50% of SMBs consider it to be harder to sustain a small business than it was six months prior.

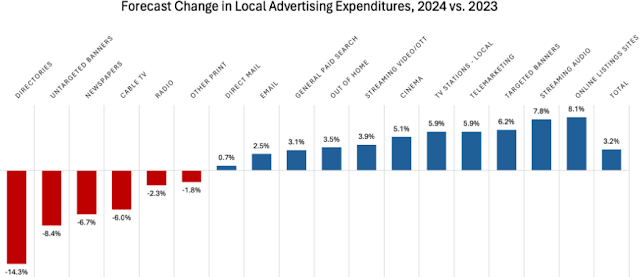

Overall, the forecast predicts a good year. Here are highlights:

- Local advertising is forecast to reach $148.9 billion, up 3.9% from 2023.

- The largest growth is forecast for online listings, which encompasses sites for cars, jobs, merchandise, real estate, and services. Local ad spending is forecast to grow 8.1%, topping $20.4 billion.

- Spending on streaming audio commercials – including podcasting and spots on radio station websites, apps, and smart speakers – is pegged for the 2nd highest growth at 7.8%. It is forecast to hit $1.2 billion.

- Targeted display advertising, driven by social media, is forecast to grow 6.2%, reaching $27.2 billion.

- Local broadcast TV advertising is forecast to grow 5.9%, hitting $9.9 billion.

- The steepest declines are pegged for yellow pages (-14.3%), untargeted banner advertising (-8.4%), print newspapers (-6.7%) and cable TV (-6.0%)

- Streaming video advertising (OTT/CTV) among local buyers is growing far slower than initially predicted. The forecast calls for 3.9% growth this year, topping $23.3 billion.

The scale-back in growth for streaming video held the biggest surprise for Elliott.

“While there’s a lot of passion around digital video, it presents a bit of a challenge for local businesses,” he said. “They’ve been telling us in surveys that they don’t know how to purchase it or how it fits into their marketing plan. They aren’t even aware that it’s cheaper than broadcast TV. That all points to a more subdued ramp-up for OTT spending.

Borrell’s latest release includes new forecasts for all U.S. markets, where shifts in the composition of local businesses have translated to significant differences from U.S. average growth rates. For instance, spending on newspaper advertising in Albany, NY, is forecast to grow 3.7% this year, while it’s forecast to decline 13.6% in Williamsburg, VA. In Little Rock, AR, radio spending is forecast to grow 7.3%, but decline by 7.0% in Baltimore, MD.

In addition to the 2024 forecasts, Borrell extended its’ long-range outlook to 2028. By then, Borrell’s forecast engine puts total local advertising at $161.2 billion, or 11.8% more than it was in 2023. Five years from now, the three advertising formats will all be basically tied for first place: General Paid Search ($32 billion), Targeted Online Display ads ($30.3 billion), and Streaming Video/OTT/CTV ($30.0 billion). Broadcast TV clocks in as the fourth-largest at $9.1 billion.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.